The SEC Marketing Rule (the “Marketing Rule”) has been in effect for nearly two years and remains a central focus of the SEC’s 2024 exam priorities. The 28th Annual Global Investment Performance Standards (GIPS®) Conference was held in San Diego, California on September 17-18, 2024. The opening session of the conference addressed the challenges firms face in complying with the Marketing Rule. This session featured Michael McGrath, CFA, Partner at Dechert; Robert Shapiro, Assistant Director of the SEC’s Division of Investment Management; Karyn Vincent, CFA, CIPM, Senior Head of Global Industry Standards at CFA Institute; and Ken Robinson, CFA, CIPM, Director of Global Industry Standards at CFA Institute.

The panel provided valuable insights into how firms are managing regulatory risk related to the Marketing Rule and discussed findings from a recent survey conducted by the USIPC and Investment Adviser Association (IAA) on current practices for meeting the Marketing Rule's performance requirements.

The USIPC and IAA conducted a survey to evaluate current practices for complying with the performance requirements of the Marketing Rule. The survey results showed that it is becoming increasingly more common for firms to calculate composite net-of-fees returns using a model fee rate, rather than actual fees. Larger firms reported that using actual fees to calculate net-of-fees returns can be operationally challenging, especially when portfolios have more complex or negotiated fee agreements. In contrast, firms with more standardized fee structures may find it simpler and more practical to use actual fees. However, when the panelists polled the conference audience, the results showed a roughly 50/50 split between firms using model fees and those using actual fees to calculate net returns. In practice, we have observed firms moving away from using actual fees and instead are now reducing gross returns by a model management fee for some if not all of their composites.

- Robert Shapiro, Assistant Director in the SEC’s Division of Investment Management, expressed concerns about advisors presenting returns net of actual fees to prospective investors who would be paying higher fees. Karyn Vincent echoed this concern, agreeing that unless a firm has maintained consistent fees over time, it can be challenging to argue that a net return using actual fees complies with the Marketing Rule.

- Mr. Shapiro pointed out that, although the SEC recognizes firms are presenting various "performance-derived" statistics in marketing materials, they do not consider metrics like standard deviation and attribution effects as "performance." However, contribution remains a gray area, subject to interpretation. Mr. Shapiro also cautioned firms to be mindful when making statements that could be interpreted as "performance." For example, claiming that your firm outperformed other managers requires substantiation. Firms must ensure they can back up and can support such performance-related statements.

- Another repeat topic of conversation from last year’s conference was the presentation of gross and net IRR by managers of private funds that use subscription lines of credit. The requirements of the Marketing Rule are intended to facilitate comparison and to help investors understand the impact of fees on their accounts. While there are many valid ways of calculating performance, when gross returns are presented, the Marketing Rule requires net and gross returns to be calculated for comparison purposes using the same methodology and for the same time period. The SEC issued an FAQ on February 6, 2024, that provides some clarification on this topic, specifically how the SEC views “time period” and “same methodology.” If the manager presents gross IRR from the time of a fund’s first investment, it must also present the net IRR calculated from the time of the first investment. If the manager presents net IRR from the time of the first LP capital call, it must include either (a) net IRR calculated from the time of the first investment (i.e., the return without the impact of the subscription line of credit), or (b) disclosure describing the impact of the subscription line of credit on net performance. Mr. Shapiro stated that presenting performance exclusively over the shorter time period would be misleading. Panelists agreed with Mr. Shapiro and felt that the degree to which the track record has been truncated should determine how prominently the accompanying disclosure is presented.

- During the session that Mr. Shapiro was on, the panelists discussed several case studies, but one of the more interesting case studies related to the Marketing Rule’s requirement that when gross and net performance are shown,

the net performance must be (1) presented in equal prominence to, and in a format designed to facilitate comparison, and (2) be calculated over the same time period, using the same type of return methodology.

the net performance must be (1) presented in equal prominence to, and in a format designed to facilitate comparison, and (2) be calculated over the same time period, using the same type of return methodology.

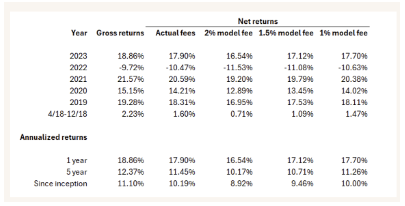

The panelists concluded that to help standardize marketing materials for firms that offer different fee schedules to different types of prospects, firms could consider including multiple net return series in one marketing piece and an example was offered. A reminder was noted that, while it doesn’t have to be in exactly the same format, this approach is permissible for firms claiming compliance with the GIPS standards.

Click here for the full conference recap.